Nonprofit Technology & Fundraising Blog

Subscribe to our mailing list

November 2, 2022 | Online Fundraising

Put yourself in your donors’ shoes for a second, and think of a recent purchase or donation you made on your mobile phone, tablet, or laptop. Did you have to enter your card information manually? Did it take you longer than a minute to check out? Did you abandon your purchase altogether? What held you back from having a frictionless experience?

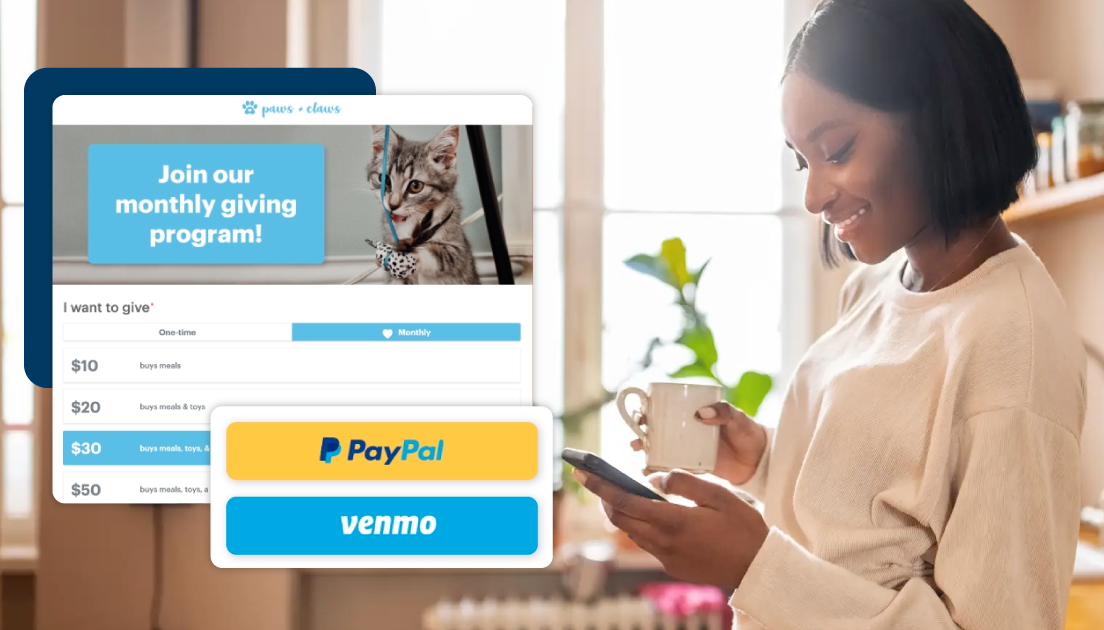

Digital and remote payments are driving card volume and they will soon replace credit cards as the most used payment method for eCommerce transactions. For nonprofit organizations, digital wallets like PayPal and Venmo reduce donor checkout friction, inspire trust, and increase unplanned gifts1 (by 32%) and repeat donations2 (by 79%). Donors can make their payment via desktop, tablet, or mobile in under a minute, without having to fill out credit card numbers, addresses, and other time-consuming, error-prone form fields.

An online donation form is a vital component of any fundraiser’s toolbox, and knowing how to optimize a form’s conversion rate will help to guarantee its success. Nonprofits inspire their supporters to complete and increase their gifts by making the donation process a simple and rewarding one. As a donor, digital wallets save time, energy, and worry, because your funds are stored in a password-protected, PCI-compliant account that you trust, and without entering any information, you can securely send them to the desired recipient. As a fundraiser, digital wallets are just as quick, easy, and secure as physical ones with cash.

To improve your nonprofit’s conversion rate, you can reduce checkout friction on your online donation form by shortening the length, reducing copy or required fields, providing flexibility through multiple payment options, and enabling digital wallets like PayPal and Venmo.

Having PayPal available as a payment method on your form reduces the need to fill out payment fields – you save the donor from having to dig their credit card out of their wallet or purse because their payment information is already saved for them in their PayPal account. Additionally, PayPal’s One Touch feature means that donors may not even have to enter their username and password.

Building trust through your form is one of the best ways for you to ensure a healthy conversion rate. Branded forms have significantly (6x) higher conversion rates because a donor is more likely to trust where their donation is going. Not only do branded donation forms secure more donations, they also process larger donations. According to QGiv, donors give 38 percent larger gifts to branded donation pages than to generic pages.

With security breaches becoming more and more prevalent, knowing that an online transaction is safe and secure is at the forefront of many peoples’ minds when they pull out their credit card or bank information.

PayPal is the second most trusted brand globally and with good reason. It is recognized and relied upon by hundreds of millions of people worldwide and they have one narrow focus, secure payments. Adding PayPal as an option on your online donation form will help eliminate donor hesitancy over any security concerns. Take advantage of PayPal’s reputation and include it as a payment option on your forms to set your donors’ minds at ease.

To make sure your nonprofit story and call to action are heard, it’s important to meet donors where they are – and usually that’s on their phone. Having forms that are mobile-friendly ensures that your donors have a positive experience and stay on your page to complete their donation or sign up for monthly giving. In fact, donors are 34% more likely to give on mobile-responsive sites. Pairing a mobile-friendly donation form with PayPal as a payment option will help create an easy, end-to-end donor journey for your supporters – all on their mobile device.

[1] Nielsen, commissioned by PayPal, April 2022. Nielsen Media Behavioral Panel of US with 590 Non-Profit desktop donation transactions from January 2021 to December 2021. *Checkout conversion is measured from the point at which the customer starts to pay for the donation.

[2] Nielsen, commissioned by PayPal, April 2022. Nielsen Media Behavioral Panel of US with 590 Non-Profit desktop donation transactions (January 2021 to December 2021) Uplift % of PayPal users making two or more donations on the same website (45.5%) vs. Non-PayPal users making two or more donations on the same website (25.4%).

[3] Nielsen, commissioned by PayPal, April 2022. Nielsen Media Attitudinal Survey of US (January 2022) with 200 recent PayPal donations and 200 non-PayPal donations (past 3 months) from Non-Profit organizations. ‘Typical Checkout’ includes other mobile wallet options, credit/debit cards, buy now/pay later, prepaid/gift cards, cryptocurrency, and more.

[4] [6] Nielsen, commissioned by PayPal, April 2022. Nielsen Media Attitudinal Survey of US (January 2022) with 400 recent donations (past 3 months) to Non-Profit organizations. Base: 338 PayPal users.

[5] Nielsen, commissioned by PayPal, April 2022. Nielsen Media Behavioral Panel of US with Non-Profit desktop donations transactions from 1,720 consumers, from January 2021 to December 2021.

Follow us on social!